This article was updated in April 2025 following its original publication in September 2024.

In recent years, commodity markets have been significantly volatile. From the end of 2021 and through 2022, sharp price increases were experienced in energy, metals, polymers, packaging materials, wood, and other raw materials. In 2023 and 2024, prices for commodities such as steel, polymers, and energy have decreased. In 2025, evolving global trade policies and tariffs may introduce new scenarios for price increases, potentially impacting ex-works and landed costs.

Would you like to learn more about our Operations Practice?

Purchasing organizations, which had until recently been grappling with steep price increases from suppliers, find themselves needing to adjust commodity and component prices back to a “fair price” level, based on actual raw material cost and energy price developments.

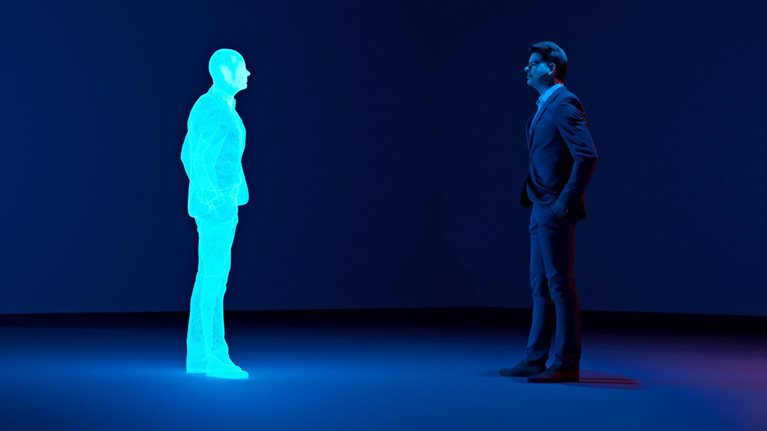

How do purchasing organizations address this? A key factor for achieving fair prices with suppliers, whether in times of rising prices or declining markets, is an analytical understanding of the impact of changes to input cost drivers. This can now be done by using a spend digital twin. This tool facilitates a comprehensive analysis of the entire spend, enabling a more detailed examination of cost drivers at the category level, and assessing the impact of their market development over time to establish a robust fair price in relation to supplier’s price.

To read the full article, download the PDF here.