Last year, quantum technologies moved closer to fulfilling their promise to resolve challenges that are impossible or prohibitively expensive to tackle with today’s technologies. Our updated analysis for the 2023 Quantum Technology Monitor shows that the four industries likely to see the earliest economic impact from quantum computing—automotive, chemicals, financial services, and life sciences—stand to potentially gain up to $1.3 trillion in value by 2035.

Pursuing a share of that value, in 2022 investors poured $2.35 billion into quantum technology start-ups, which include companies in quantum computing, communications, and sensing. The total edged out 2021’s record for the highest annual level of quantum technology start-up investment. In fact, four of the biggest deals in the 2000s closed last year.

Behind many quantum technology start-ups are technical breakthroughs, and 2022 saw several notable ones. A few examples include the awarding of the Nobel Prize in Physics to pioneering researchers in quantum entanglement, a company that presented a quantum processor with hundreds of quantum bits (qubits) and a road map to build one with thousands of qubits by 2025, and another company that demonstrated quantum advantage in a sampling problem using its photonic quantum computer.

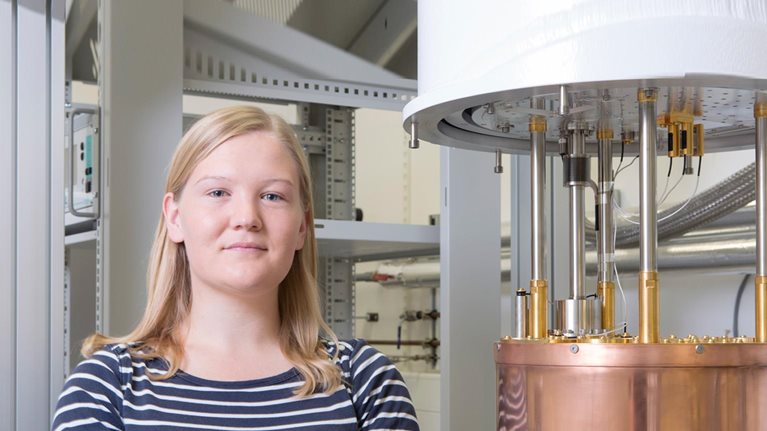

Talent with relevant expertise can propel the industry to future technical breakthroughs. While talent is still in short supply, the gap appears to have narrowed in the past year, thanks in part to universities creating new master’s degree programs in quantum technologies.

In this article, we share these and other highlights from this year’s Quantum Technology Monitor (for more on the research, see sidebar, “About the Quantum Technology Monitor research”).

A more established ecosystem attracted record investment, but the pace of start-up creation slowed

Worldwide investments in quantum technology start-ups reached their highest levels in 2022, at $2.35 billion, a modest 1 percent increase from 2021 (Exhibit 1). About 68 percent of all start-up investments in quantum technology since 2001 have streamed into the industry over the past two years, an indication of investor confidence in the technologies’ future commercial potential.

But the rate of new-company creation has not kept pace with investments. Only 19 quantum technology start-ups were founded in 2022, compared with 41 in 2021, bringing the total number of start-ups in the quantum technology ecosystem to 350. This suggests that more investments are going to established start-ups than to new companies.

There are a few reasons why start-up formation might be slowing. First, the experienced talent in the field who would normally be the most likely to start new companies—usually based in academic research—may already be working for start-ups. The limited number of use cases that are sufficiently developed for eventual commercial implementation may also be dampening new-company creation. Finally, investors may prefer to invest in later-stage start-ups and young companies ready to scale.

Some established quantum technology companies have already been the focus of large deals. Four of the ten largest investment deals since 2001 closed in 2022, at values of up to $500 million. And seven of the ten largest deals in 2022 were worth more than $100 million. While the largest deal was for a software company, eight of the ten largest were for hardware companies, partly because hardware is the most capital-intensive part of the quantum technology value chain.

The public sector has also continued to commit investments in quantum technology. In 2022, the United States committed an additional $1.8 billion in funding, with $1.2 billion more committed by the European Union, and an additional $100 million from Canada. However, China’s total announced investment of $15.3 billion still stands as the highest in the world, even without an additional commitment this year.

Would you like to learn more about McKinsey Digital?

Scientific breakthroughs continued but showed signs of slowing

Quantum technologies were able to take a victory lap thanks to some high-profile recognition in 2022. Alain Aspect, John Clauser, and Anton Zeilinger, who worked on quantum entanglement in their research groups, received the Nobel Prize in Physics in 2022.1 While the three’s accredited work occurred decades ago, technological progress occurred in 2022 as well. For instance, IBM unveiled a 433-qubit quantum processor and plans to build a 4,000-qubit processor by 2025.2 In another example, Xanadu used its photonic quantum computer to demonstrate quantum advantage in Gaussian boson sampling (a probability-distribution sampling problem), following the precedent set by two other teams.3

However, these hard-earned breakthroughs stand out among a slowdown in quantum technology research. Worldwide, 1,589 quantum technology–related patents were granted in 2022, 61 percent fewer patents than in 2021. And from 2021 to 2022, the number of published papers on quantum technology declined by 5 percent.

These trends could be a sign that the remaining challenges are more difficult to solve. Indeed, perhaps the most pertinent and harrowing problem stands unsolved: building a quantum computer with a sufficient number and quality of qubits to ensure computation remains uncompromised by errors—that is, “fault tolerant.” While the size of quantum computers (in terms of the number of qubits within them) and qubit fidelities have been growing steadily individually, this hasn’t yet occurred in tandem. In other words, a larger quantum computer will usually have a lower fidelity than a smaller one.

In each of the five main approaches to quantum computers, difficult challenges remain. For example, photonic-based devices still “leak” photons, resulting in computation failures. Ion-trap and neutral-atom-based devices have not yet demonstrated an ability to rapidly conduct computation as qubit counts grow. Spin and superconducting devices still need to scale their control and cooling systems to handle potentially thousands of qubits.

The Rise of Quantum Computing

The talent gap seems to be narrowing but remains significant

The talent gap in quantum technologies narrowed in 2022. Our analysis shows that nearly two-thirds of open jobs in the industry (450 out of 717) could be filled with new master’s-level graduates in quantum technologies in 2022. In 2021, only about a third of those jobs (290 out of 851) could be filled (Exhibit 2).

This progress occurred even though the number of job openings in quantum technologies increased by 19 percent from 2021 to 2022. Going forward, the gap could narrow further, in part because more academic institutions are integrating quantum into their curriculums and because universities produced 55 percent more master’s-level graduates in quantum technologies. According to our research, the number of universities with formal master’s programs in quantum technologies shot up from 29 in 2021 to 50 in 2022.

Our analysis shows that the remaining jobs could be filled by graduates from fields that are related to quantum technologies, which produce approximately 350,000 master’s-level graduates per year worldwide. Talent in these fields—biochemistry, chemistry, electronics and chemical engineering, information and communications technology, mathematics and statistics, and physics—is most plentiful and concentrated in the European Union. In 2020, 303 out of every million EU residents were newly minted master’s-level graduates in a field that is relevant to quantum technology (Exhibit 3).

Additionally, the worldwide pool of working talent with some knowledge relevant to quantum technologies could be upskilled to meet the industry’s needs. For instance, systems architects, AI and machine learning algorithm developers, and others with traditional coding and AI skills could be upskilled in as little as six months to code and improve quantum algorithms. Of course, even at a time when technology firms are shedding workers, such talent is already highly sought-after.

For the full set of insights and data, download the entire Quantum Technology Monitor.