Geopolitical and structural changes have been redrawing global trade patterns, with an estimated $12 trillion to $14 trillion in trade expected to shift across trade corridors by 2035. Despite these challenges, global trade is projected to grow from $33 trillion in 2024 to $42 trillion to $45 trillion by 2035.1

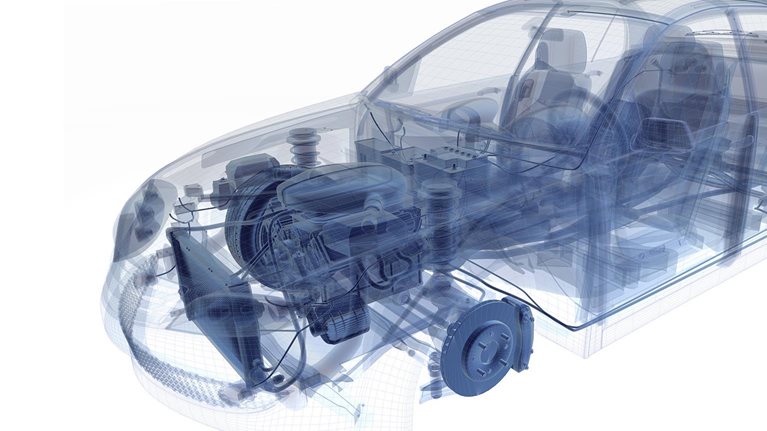

The auto component industry has been heavily affected by trade corridor shifts. India is now emerging as a key player in this realignment, helped by its cost competitiveness, skilled workforce, and growing domestic market.2

This is evidenced by a steady expansion of opportunities in the domestic and export markets and a CAGR of about 10 percent over the past five years in the Indian auto component industry. With domestic and export demand rising further, this industry is projected to reach $200 billion by 2030.3

The two pillars driving this growth are a $20 billion to $30 billion internal combustion engine (ICE) export opportunity by 2030 as global markets consolidate, and a 35 percent CAGR in domestic electric vehicle sales, in line with rising worldwide electrification and connectivity.4

As these structural changes play out, they create short-to-medium-term disruptions in global trade flows, with implications for India’s automotive component value chain.

- Reliance on critical components such as rare earth elements and semiconductors, the bulk of which are in China, creates supply risks and a need to diversify sourcing.

- Capability gaps in advanced technologies, high and growing import dependence, and limited investment in R&D for sustainable alternatives undermine global competitiveness.

- Policy shifts and carbon taxes in trade with developed markets are seeing suppliers set up local production in export markets, adopt greener practices, and diversify the export customer base.

- Micro-, small, and medium-size enterprises (MSMEs), which contribute approximately 40 percent to industry revenue,5 face structural inequities such as a lack of economies of scale, rising costs, limited access to global markets, and the need for technology upgrades.

To navigate the evolving landscape and capitalize on emerging opportunities that lock in long-term value, the industry could consider the following two approaches:

- The IGNITE approach:

- ICE Global play can be enhanced by upgrading and refining supply chain strengths, paving the way for India to secure the “last person standing” advantage.

- New technology can be developed to future-proof the industry and ensure relevance in emerging powertrains.

- Investment in critical capabilities, such as global sales expertise and adherence to quality standards, can enhance competitiveness in the global marketplace.

- Talent rewiring can create an effective future-ready workforce and close gaps between academic and industry training and the skill sets required on the ground.

- Engagement with industry peers, academia, and start-ups can drive innovation, create intellectual property, and design relevant curricula in institutions.

- The GAIN approach (Government, Association, Institutional finance support, and Network effort of MSMEs) to collaborations can serve as the primary lever to address systemic challenges, secure access to critical resources, and encourage innovation. Strategic trade agreements, infrastructure enhancements, and financial support will further strengthen the industry’s global position.

With these moves, the Indian auto component industry can weather short-to-medium-term disruptions and establish itself as a key player in global automotive value chains.