This interview is part of the Leading Asia series, which features in-depth conversations with some of the region’s most value-creating leaders on what it takes to realize bold ambitions and take them further.

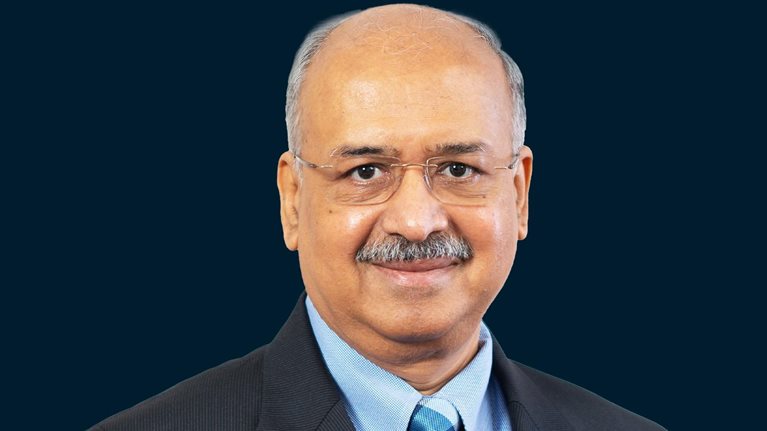

In this Leading Asia interview, Joydeep Sengupta, a senior partner at McKinsey, talks to Uday Kotak about his philosophy behind growing his business in India’s emerging financial services sector, the benefits of partnerships, and how dreaming is one of the most powerful tools for risk management.

In 1985, at age 26 and with a small loan from family and friends, Uday Kotak started Kotak Capital Management Finance Ltd. His entrepreneurial spirit and innovative business approach, along with strategic partnerships, grew the company into Kotak Finance Ltd, which diversified into investment banking, car and life insurance, mutual funds, and stockbroking. In 2003, the company became the first nonbanking financial institution to be granted a banking license from the Reserve Bank of India, leading it to become one of India’s most prominent private sector banks, Kotak Mahindra Bank.

Joydeep Sengupta: To understand what it takes to create value in Asia’s volatile and exciting environment, I’m delighted to be joined by Uday Kotak, the founder of Kotak Mahindra Bank.

Uday, we are presently researching the top value creators in Asia over the past 25 years to try to unravel what it takes to achieve this status. Certainly, you stand tall in the list of people who have created extraordinary value. Tell us about your journey, as well as your secret sauce.

Uday Kotak: I don’t think that there is necessarily a secret sauce. There are two considerations. First, I believe that opportunity comes from being in the right place at the right time. I consider myself fortunate to have been in India at a time when the financial sector and the economy were opening up post 1984–85, when I was just starting out.

The second factor was a significant focus on common sense. Once I had decided to be an entrepreneur, I started looking for what opportunities were available. By far the biggest was the imperfect financial sector marketplace. Banks used to take deposits at 6 percent, and the lending rate was fixed by the central bank at 17 percent, irrespective of the quality of the borrower. So, conditions for getting credit were clear opportunities to find a way of intermediation.

I believe that one of the most important things about entrepreneurship is that there comes a time when an entrepreneur needs to transition to a significantly more structured firm process. Risk management becomes extremely important. I experienced two or three major external events in the Indian financial sector, which were big warning signs for me.

In 1991, after a balance of payments crisis in India, the new finance minister presented an amazing budget, after which many opportunities started opening up. Then, in 1992, when we were still in the first five or six years of our journey, there was the securities scandal. That gave us a bird’s-eye view into what risk management was about, and how risk-adjusted returns and events outside your control can effectively destroy your business model. After the securities scandal, the Reserve Bank of India stopped banks from rediscounting bills for private companies. That forced us to reinvent ourselves. Fortunately, in 1991, we had started a car finance business, which was working on significant spreads.

We were a bit like frogs in the well in India in the ’90s. How were we going to find out about global capital markets? How could we learn the skills and processes that, for example, Ford Credit had used to become a car finance business? We needed to open up to the world. So, we pursued the capital markets and, in fact, pursued Goldman Sachs to partner with us in investment banking and securities. This was our first joint venture, where we owned 75 percent and Goldman Sachs owned 25 percent.

At around the same time, we went into a joint venture with Ford Credit. As you may recall, Anand Mahindra was an early investor in our company. In 1985, he had entered a joint venture with Ford, and therefore we did a joint venture in car finance. We learned a lot out of partnering with these two global firms in the ’90s.

When I think about the whole journey, I don’t think there was a secret sauce. It’s more about keeping your head on your shoulders. On stage at the World Economic Forum in 2009, Fareed Zakaria asked me, “What makes a good banker?” I replied, “A good banker must have three qualities: prudence, simplicity, and humility.” These qualities still matter and will always matter. If there is any secret sauce, it is these three human qualities.

Joydeep Sengupta: What was the logic behind getting into those partnerships—was it to acquire skills or to build your own talent?

Uday Kotak: We learned a great deal from each of our partners. In the 2000s, we adopted the mindset that we would get into any new area in the financial sector, even if we didn’t have all the knowledge. We managed to do so by gaining knowledge from our partners. For example, when India’s financial sector opened up for insurance, we wanted to get into that area, and so we partnered with Old Mutual in 2000–01. In this, and our joint venture with Goldman Sachs, we kept the majority of shares. The technology and knowledge we got from them, and the understanding of how these sectors worked, were very valuable to us on our journey.

We changed strategy after 2005 because we felt that India had developed considerably. Contrary to what some of the other global firms did with their domestic partners, we bought back Goldman Sachs’ and Ford’s stakes, and later on, we bought back the stake in the life insurance company from Old Mutual.

One of the most powerful tools for risk management is dreaming. People underestimate the fact that you have to dream to build a business for sustainability and continuity.

Joydeep Sengupta: When you started your journey, did you ever imagine you would be where you are today? Did you have a big, bold ambition as to where you would be in 2025?

Uday Kotak: Joydeep, we always dream. One of the most powerful tools for risk management is dreaming. People underestimate the fact that you have to dream to build a business for sustainability and continuity. The mix of these two dreams has always possessed Kotak and our senior team.

As far as where we stand today, I genuinely believe we are still very small in the bigger scheme of things; I don’t think about us as being big. The size of the opportunity in the Indian economy and the world at large is still huge.

Joydeep Sengupta: Early on, you obviously made choices whether to build just your banking business and scale that, or to enter nearly every space in financial services. Was this a diversification strategy?

Uday Kotak: I think diversification revolves around flexibility and context, but deep down, it’s also about understanding your strengths and weaknesses when you make the call. My view is that the decision to be in the spaces you’re in, say, like the financial sector, also depends on the evolution of the economy and the depth of each of the businesses. When we started, many sectors were relatively new and were not even open to the private sector. There were no new banks back then; there wasn’t insurance.

A second consideration is that India was a tough terrain in which to build a business. We were in financial services in an evolving economy, and we had Indian expertise. So, we had the horizontal versus the vertical but were still sectoral in financial services. Over time, as the verticals got bigger, we started thinking about making them even more vertical. Yet, some businesses did not give us the ability to become global vertically—for example, investment banking. If we had only been only vertical in that area, it would have been much tougher to compete with Goldman Sachs or Morgan Stanley on the global investment banking stage.

I’m happy to say that in 2024, the largest equity capital raised in the world after the United States was in India. India has scale, and Kotak Mahindra has positioned itself within that, whether in investment banking, securities, or asset management. We are relatively new to the general insurance business—last year, we partnered with Zurich Insurance, a global insurance company, to become a 30 percent shareholder.

So, I do not believe that everything is cast in stone; you must keep an open mind. There was a time when we were minority partners; then there was a time we owned 100 percent of all our businesses.

Joydeep Sengupta: You have a team that you have kept together for over 25 years. Yet many from the outside might say that is not the best talent available in the market. You appear to have been able to have average talent do extraordinary things with you. How did you achieve that?

Uday Kotak: I believe that culture eats strategy for breakfast. We have built a middle-class value stream. I was born into a joint family with 63 family members in one home; we were all different but my forefathers made it work. That had a big influence on how we built the company. It created significant bonding and enabled us to put people into new areas to keep them motivated. We took an enormous number of risks on people. Fortunately, it worked for quite some time. Having said that, if I look back, we should have also kept acquiring fresh talent along the way. But the team that built Kotak’s first 20 to 25 years was a middle-class values team with a huge commitment to making the dream happen—not chasing the stock price but chasing a purpose.

Joydeep Sengupta: Why did you choose to put your name on the bank?

Uday Kotak: At first, the bank was only called Kotak. Then, when Anand Mahindra came on board, it became Kotak Mahindra. In my first meeting with Anand—when he took a stake in 1986—I said, “If you look at J.P. Morgan, Goldman Sachs, or Morgan Stanley, they put their names on the line. Let’s put our names and reputations on the line to build trust.”

The choice was clearly motivated by a desire to create perpetuity and reputation and an institution built to last. Our choice, therefore, was driven by a deep philosophy that we wanted to build something great for ourselves, for India, and for the world. You must create things to last, because if what you build does not outlast you, you will have failed.

Joydeep Sengupta: We are currently in a world with a lot of disruption, and the premium on innovation has gone up considerably. How have you adapted to that?

Uday Kotak: I believe that technology is a big opportunity and a significant disruptor, and we have embraced digital since 2017. We realize we have to be able to build a customer franchise that focuses much more on mobiles and computers, while the density of physical branches will reduce.

Then there is talent: One of the biggest challenges banks of the future will face is the ability to attract the best talent. In addition, we believe that the future has to be much more technology-driven, but how do you match that with the customer’s need for a relationship? I think a combination will work—but you still have to go all out to embrace technology.

Joydeep Sengupta: How do you go from strength to strength through a crisis?

Uday Kotak: First, you must have a proactive rather than reactive mindset. As I said earlier, the function of risk is a function of dreaming. Thanks to my grandfather, I have a “what if” mindset, which is now deeply ingrained in the Kotak DNA. Dreaming about growth and opportunity is very important but so is dreaming about what can go wrong. You even have to consider the impact of a low-probability event. That is where you start converting risk into risk-adjusted returns.

Joydeep Sengupta: I find that many professional CEOs struggle with board management. As a founder, do you think that has given you an advantage in terms of how you govern the board?

Uday Kotak: When I was CEO, I had the advantage of being the founder. However, I always ensured that I was accountable to the board. In my mind, my managerial role and my owner role were two different positions. I had to be tough on myself as a manager, wearing the hat of either a board member or a shareowner. That ability to be surgically distinct is extremely important for building boards’ and shareholders’ trust. I think that professional CEOs have a challenge, especially in the early stages of their roles, but they can build confidence with their boards. The most outstanding example in my mind is Aditya Puri, who was CEO [of HDFC Bank] for 26 years.

Joydeep Sengupta: Now that you’ve given up one hat, do you feel life has changed in terms of coming back to the value creation story for you?

Uday Kotak: I had three roles previously—a manager, a board member, and a strategic shareholder. I have now shed the role of being a manager, but I continue to be a board member and strategic shareholder. Giving up the first role has been a relief, because running a bank has become far more complex and less fun than in earlier days. The change has also enabled me to pursue other things while continuing to be involved with the institution. I deeply value my roles as a nonexecutive director and a founder. I am conscious of the fact that our brand and reputation are reliant on the board—it’s a huge responsibility. I am in the same boat as the shareholders, as how the company performs affects all of us in a similar way.

Joydeep Sengupta: You raised the notion of intergenerational ownership—how do you see that?

Uday Kotak: It’s up to the institution; time will tell. I believe that institutions have to last beyond individuals. Don’t chase legacy and don’t chase stock price. I believe you must work on inputs and doing what you feel is right—never just focus on the output.